Paying the tyre fee under the Waste Minimisation (Tyres) Regulations 2023

Information for importers of loose tyres, road registered vehicles, off-road vehicles, aircraft and onshore tyre manufacturers on the tyre fee and how it is collected.

Information for importers of loose tyres, road registered vehicles, off-road vehicles, aircraft and onshore tyre manufacturers on the tyre fee and how it is collected.

Importers and onshore tyre manufacturers are required to pay a tyre stewardship fee on all regulated tyres entering the New Zealand market from 1 March 2024.

The Ministry for the Environment (the Ministry) and the NZ Transport Agency Waka Kotahi (NZTA) are responsible for collecting the fee.

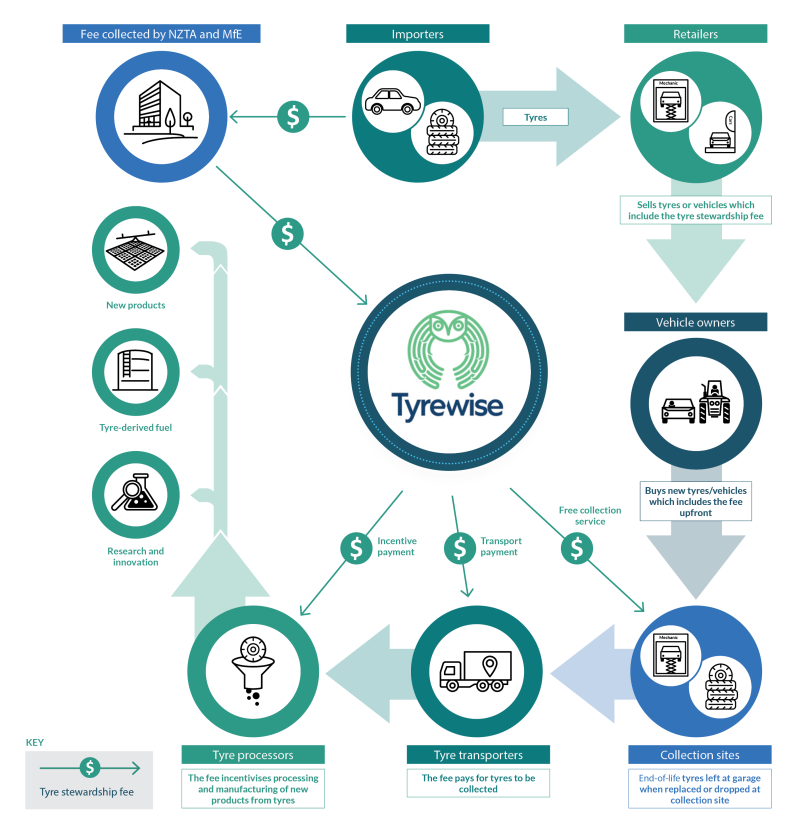

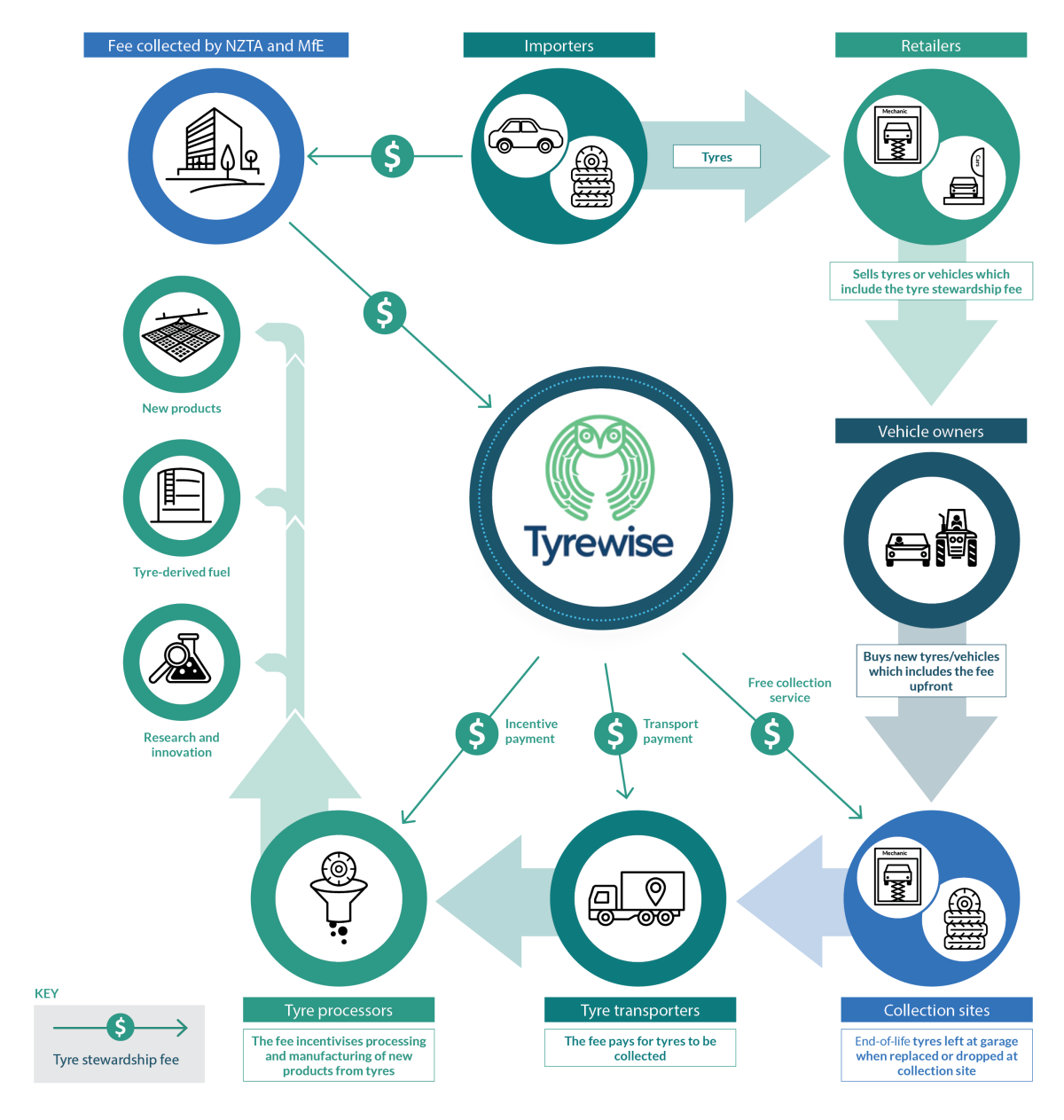

The circular Tyrewise cycle is:

The circular Tyrewise cycle is:

The Ministry collects the fee for imports of loose tyres as per section 9 of the tyre regulations [New Zealand Legislation website].

The fee categories for loose regulated tyres are based on an average equivalent passenger unit (EPU) for each tariff code. The process for selecting the correct tariff code has not changed and is administered by Customs.

Additional guidance to help you classify regulated loose tyre imports is available at:

NZTA will collect the fee for tyres attached to imported road-registered motor vehicles (as defined by the Land Transport Act section 2) as per section 11 of the tyre regulations [New Zealand Legislation website].

You are eligible for a refund from the Ministry if you can provide evidence that:

If you believe you have been charged the fee incorrectly for your motor vehicle class, contact NZTA.

The Ministry collects the fee for tyres attached to imported off-road vehicles and aircraft as per sections 10 and 11 of the regulations [New Zealand Legislation website].

The Ministry collects the fee on tyres manufactured and sold on the New Zealand market as per section 12 of the tyre regulations [New Zealand Legislation website].

There are currently no onshore manufacturers of regulated tyres in operation.

A regulated tyre that is retread in New Zealand is not considered to be manufactured in New Zealand and does not incur the fee at this point.

If you are a liable importer or manufacturer and you do not pay the fee you may be:

Payment reminders are provided prior to any enforcement action.

As an importer of regulated tyres, you may wish to pay the fee to the Ministry via direct debit.

To authorise a direct debit, download and complete the form.

Please return your completed form to TSFaccounts@mfe.govt.nz.

Section 14 of the regulations outlines the requirement for people to provide the Ministry with sufficient information to support their claim. Please refer to the tyre regulations for information on tyre fee exceptions and exemptions [New Zealand Legislation Website].

There is no need to apply for a fee refund for adjusted or cancelled loose tyre import entries. These refunds are processed monthly by the Ministry using Customs data.

Under the current regulations, a fee refund cannot be granted on imported regulated tyres that are later exported. However, the fee is not charged on regulated tyres that are transshipped, as they do not enter the New Zealand market.

If making a claim, you must support this with evidence that demonstrates that:

The fee being paid on loose tyres that are replacements for unsuitable tyres attached to a vehicle that is later road-registered for the first time (exception under regulation 11(6)).

The fee being paid for tyres attached to an off-road vehicle that is later road-registered (exception under regulation 11(7)).

We refund the second fee in double-charge situations. In most cases, this means the fee charged by NZTA at first registration. If your refund relates to the fee for tyres attached to vehicles, your refund is calculated by multiplying the number of tyres due for a refund of the fee by the fee per tyre for that vehicle category [NZTA website].

For example, the fee charged by NZTA for a passenger car covers the five tyres attached (includes the spare tyre). If you replaced all five tyres before first road-registration, you will receive a full refund of the fee paid to NZTA. If you replaced some but not all of the five tyres before first road-registration, you will receive a refund for the number of tyres replaced.

If your refund relates to the fee for loose tyres, your refund is calculated by multiplying the number of tyres by the fee for that tyre described in Table 1 of Schedule 2 of the regulations [NZ Legislation website].

To apply for a refund or an invoice correction, you must lodge an application as soon as you can. You must attach evidence to support your claim (i.e. tyre fee invoices).

Please download and complete the application form and send it, along with any supporting evidence, to accounts@tyrefee.govt.nz.

We process refunds claims within 30 days from when we receive them (provided you supply all required information).

To enquire about your accounts, please contact us at accounts@tyrefee.govt.nz or 0800 500 034.

Contact the Ministry at accounts@tyrefee.govt.nz or 0800 500 034 if you:

Contact the Ministry’s Resource Efficiency Policy team at ps.schemes@mfe.govt.nz if you have questions on the tyre product stewardship regulations or the tyre fee.

Contact NZTA if you believe you have been charged the fee incorrectly for your motor vehicle class.