Network for Greening the Financial System scenarios

NGFS climate scenarios – developed by a group of central banks – are a common starting point for analysing the impact of climate risks on the global financial system.

NGFS climate scenarios – developed by a group of central banks – are a common starting point for analysing the impact of climate risks on the global financial system.

The NGFS published its latest long-term climate scenarios in November 2023.

Read the report accompanying the latest NGFS scenarios

The NGFS Scenarios Portal allows the user to explore easy-to-understand overviews of the scenarios.

More in-depth data and assumptions underlying the NGFS scenarios is available from:

*Note that the climate data available at the regional level in the NGFS CA Climate Impact Explorer has its own set of limitations.

Before using New Zealand regional data from the NGFS CA Climate Impact Explorer:

The Network for Greening the Financial System (NGFS), a group of central banks – including the Reserve Bank of New Zealand – has prepared seven climate scenarios.

The NGFS climate scenarios describe how economies might evolve under different assumptions. The scenarios combine transition and physical risks and macro-financial developments.

The NGFS scenarios include physical climate risk measures, such as:

The NGFS scenarios also include transition risk measures, such as:

The NGFS scenarios are global in nature and designed for central banks, supervisors, and other financial organisations to explore possible future impacts on the financial system and economy.

The NGFS scenarios are commonly used by a variety of organisations because they cover both physical climate impacts and risks associated with transitioning to a low carbon economy.

If you are developing scenarios with a broad focus, you may find it useful to align some, or all, of your scenarios with an equivalent NGFS scenario. This will help create the structure of your scenarios by painting a picture of what is happening at a global scale.

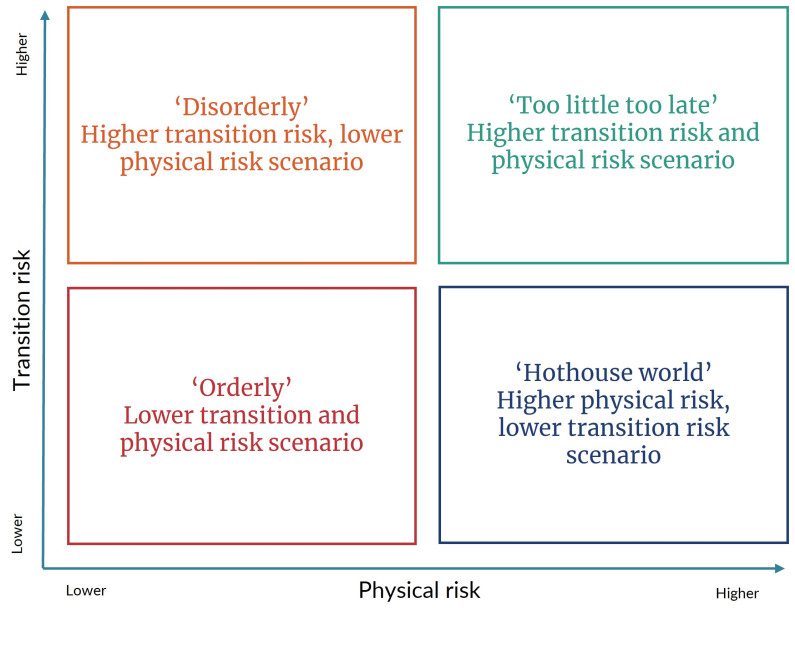

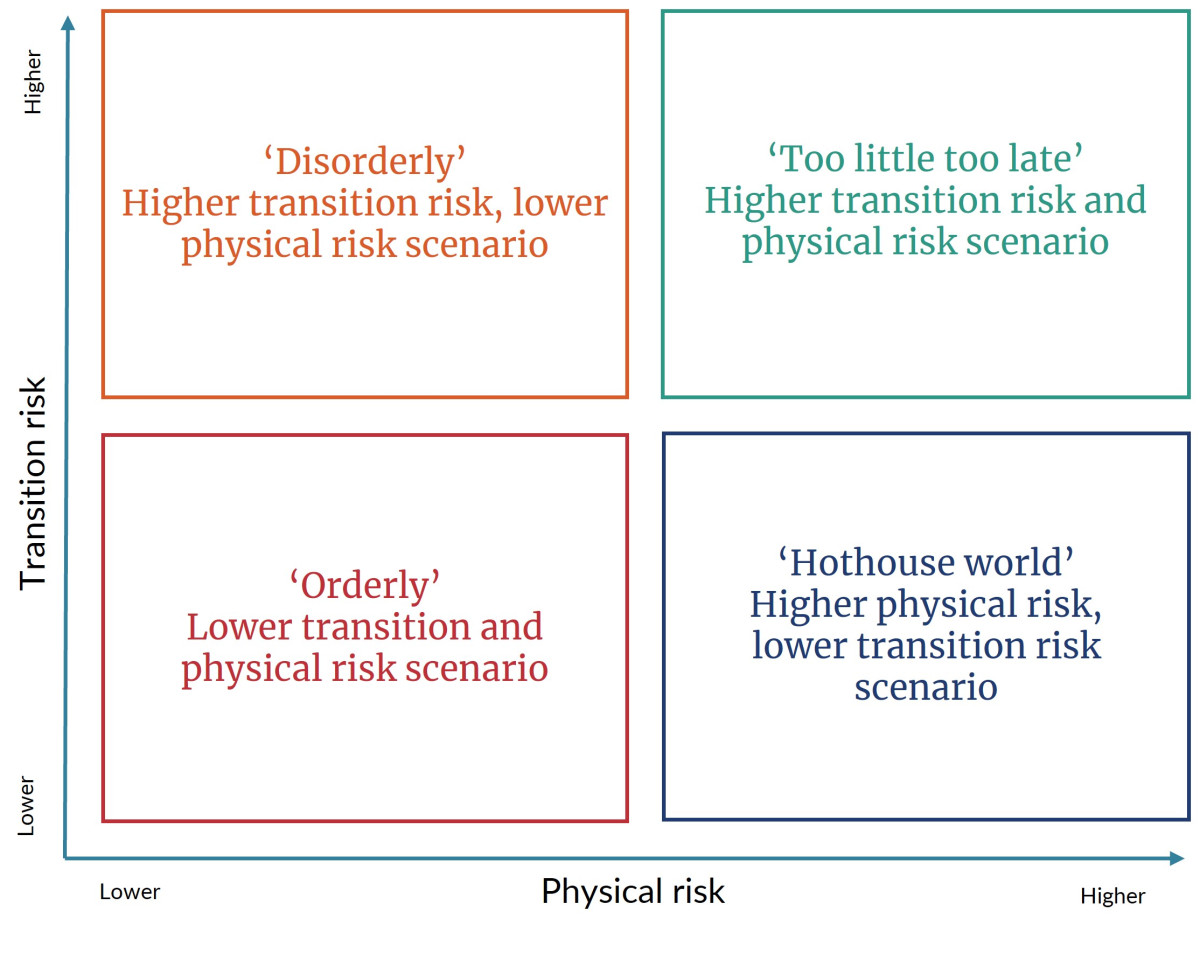

The ‘four quadrants’ developed by Network for Greening the Financial System (NGFS) is a popular framework for defining climate scenario archetypes.

The four archetypes are:

Adapted from the XRB’s Staff Guidance: Entity Scenario Development, page 29.

The diagram shows the four NGFS scenario archetypes in relation to transitional risk and physical risk.

It shows:

The diagram shows the four NGFS scenario archetypes in relation to transitional risk and physical risk.

It shows:

These four archetypes are designed so that your scenarios test differing extremes of physical and transition risks.

Read more about how to develop climate scenarios – including how to define archetypes.

Read more about using the NGFS scenario archetypes for climate-related financial reporting on page 29 of the External Reporting Board’s (XRB) Staff Guidance: Entity Scenario Development.

Note that the XRB’s guidance is designed for climate reporting entities captured under the Financial Sector (Climate-related Disclosures and Other Matters) Amendment Act 2021 [New Zealand Parliament website]. Aspects of the guidance document may not be applicable to non-reporting entities.

The NGFS scenarios are global scenarios and do not provide narratives specific to Aotearoa New Zealand.

The NGFS scenarios’ estimates of acute and chronic physical risks do not include the effects of reaching climate tipping points [Global Tipping Points website], including:

Read more about climate tipping points on pages 27-30 in the ‘What Planet Are We On?’ article [The Actuary website].

The NGFS scenarios do not capture disruptions related to geopolitical conflict, energy and supply chain dislocations, financial crises, and extreme weather events.

The assumptions underlying the NGFS scenarios underestimate damages caused by climate change and associated loss of GDP.

For more on the limitations of climate scenarios in the financial services sector, including the NGFS scenarios, see Emperor’s New Climate Scenarios report from the University of Exeter (PDF, 9.8 MB) [Institute and Faculty of Actuaries website]

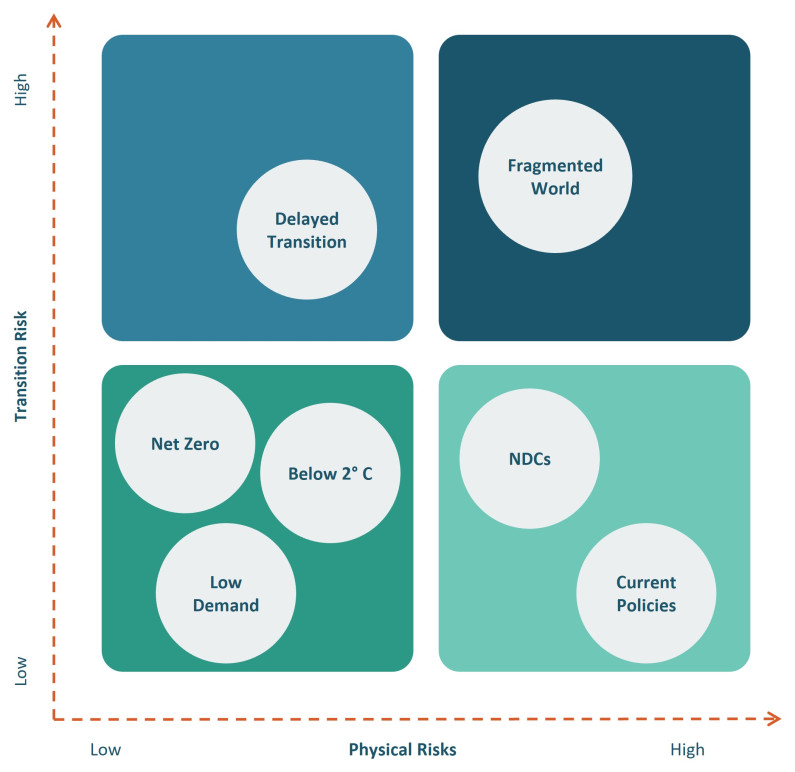

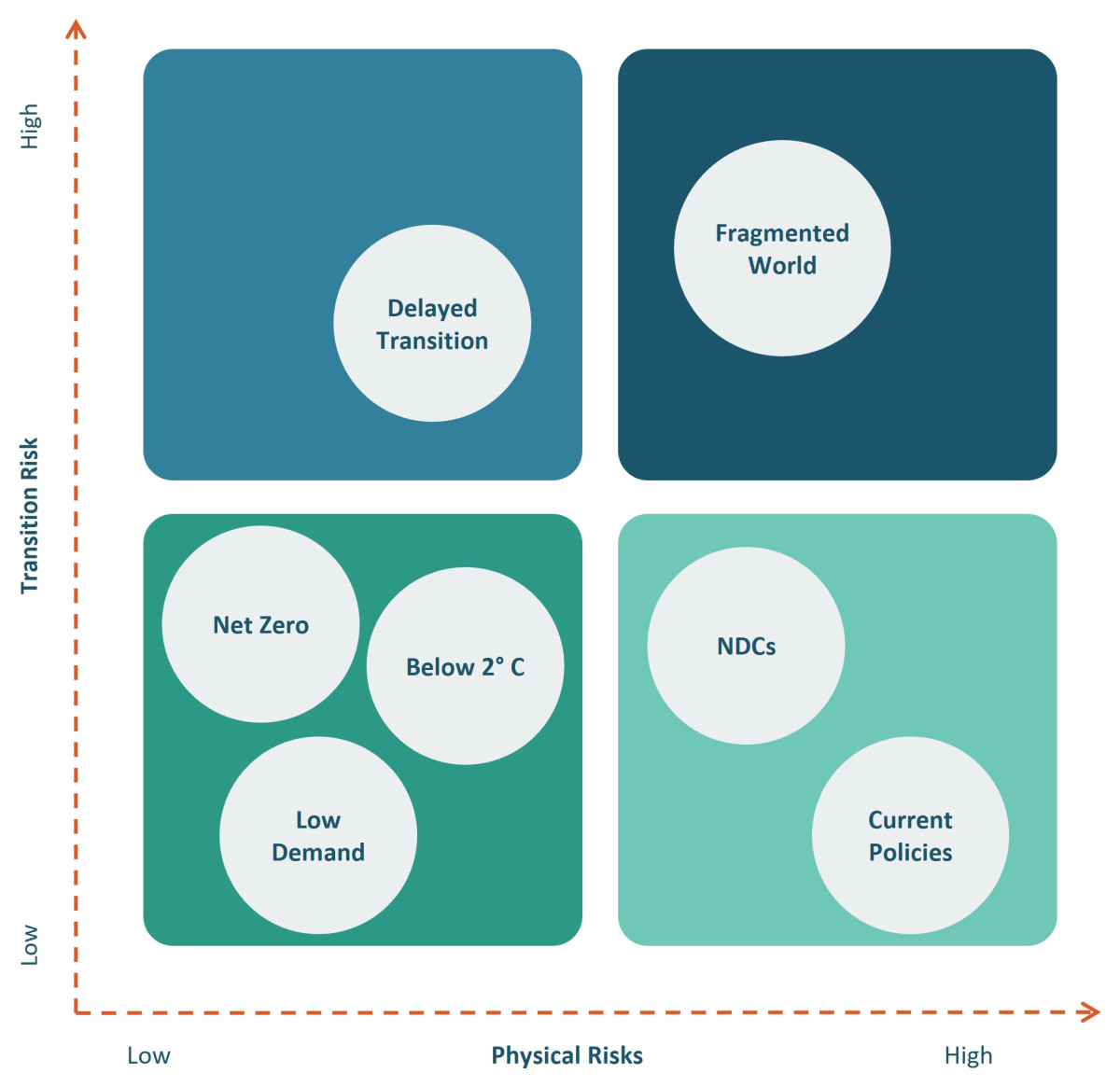

There are seven NGFS scenarios, each with a different narrative and emissions trajectory.

See text below

See text below

The Net Zero 2050 scenario describes a world where global warming is successfully restricted to 1.5°C through the implementation of stringent climate policies. Net CO₂ emissions are projected to reach zero by 2050, providing at least a 50% chance of limiting global warming to below 1.5°C by the end of the century, with minimal or no overshoot (< 0.1°C) in earlier years.

While physical risks are relatively low, transition risks are high.

Specific regions, including the US, EU, and Japan attain net zero for all greenhouse gases by 2050.

This scenario assumes:

In the Low Demand scenario, it is assumed that substantial shifts in behaviour leading to reduced energy consumption will alleviate the strain on the economic system to achieve global net zero emissions by 2050.

As a result, the shadow carbon price in this scenario may be lower than that in the Net Zero 2050 scenario, even though both scenarios aim to meet the same end-of-century warming limit of 1.5°C.

The Below 2°C scenario progressively intensifies climate policies, providing a 67% probability of restricting global warming to below 2°C. This scenario assumes the immediate implementation of climate policies, gradually increasing in rigour, although not reaching the same level as in the Net Zero 2050 scenario.

Carbon Dioxide Removal (CDR) deployment is relatively limited, and net zero CO₂ emissions are attained after 2070.

Both physical and transition risks are relatively low in this scenario compared to other scenarios.

In this scenario, the assumption is that new climate policies will not be implemented until 2030. When they are, the degree of action varies among countries and regions based on currently enacted policies. This results in a "fossil recovery" from the economic downturn caused by COVID-19.

The availability of Carbon Dioxide Removal (CDR) technologies is presumed to be limited, causing carbon prices to rise higher than in the Net Zero 2050 scenario.

Consequently, emissions temporarily surpass the carbon budget but decline more rapidly than in the Below 2°C scenario after 2030, resulting in a 67% chance of limiting global warming to below 2°C.

This scenario entails elevated transition and physical risks compared to the Net Zero 2050 and Below 2°C scenarios.

The Nationally Determined Contributions (NDCs) encompass all promised policies by countries and regions under the Paris Agreement, even those not yet implemented. In this scenario, it is assumed that the moderate and varied climate ambitions outlined in the conditional NDCs at the start of 2021 persist throughout the 21st century, resulting in low transition risks.

Despite a decrease in emissions, the outcome is still a warming of 2.6°C accompanied by moderate to severe physical risks while transition risks remain relatively low.

Under the Current Policies scenario, it is presumed that only current enacted policies continue, resulting in increased physical risks. Emissions will continue to rise until 2080, leading to approximately 3°C of warming and severe physical risks encompassing irreversible changes such as heightened sea levels.

This scenario serves as a tool to evaluate the prolonged physical risks to the economy and financial system should the current trajectory persist towards a "hothouse world."

Delayed and divergent global climate policy ambition is expected in the Fragmented World scenario. This delay results in heightened transition risks in certain countries, and universally high physical risks emerge due to the overall inefficacy of the transition.

Countries lacking zero targets adhere to existing policies, while others only partially achieve their targets (80% of the set goal). Policy ambition aligns with 2.3oC of global warming.

The NGFS published its Conceptual note of short-term climate scenarios in October 2023 in response to demand from the financial sector for short-term climate scenarios.